Bachelor of Business Administration (BBA)

Banking and Insurance

3 Years

Degree

ODL mode

Introduction

Distance BBA in Banking and Insurance is a specialized program that focuses on the principles, practices, and operations of the banking and insurance industries. It is designed to provide students with a comprehensive understanding of the financial services sector, particularly in the areas of banking, insurance, risk management, and financial planning.

In a distance BBA in Banking and Insurance program, students study the fundamentals of banking and insurance, including topics such as banking operations, financial analysis, insurance principles, risk assessment, investment management, and regulatory frameworks. They gain knowledge and skills related to financial products and services, customer relationship management, financial planning, risk mitigation, and financial regulations.

One of the key benefits of pursuing a distance BBA in Banking & Insurance is the flexibility it offers. Students have the freedom to study at their own pace and convenience, allowing them to balance their education with work or other commitments. They can access course materials, lectures, and assignments online, eliminating the need for regular on-campus attendance.

Throughout the program, students will gain insights into key areas such as marketing, finance, operations, human resources, and strategic management, all within the context of the hospitality and healthcare sectors. They will develop a deep understanding of the industry-specific challenges, trends, and best practices, enabling them to make informed decisions and drive business growth.

Distance BBA in Banking & Insurance Courses

Eligibility

10 +2 (minimum 50%)

Duration:

3 years

Location:

Navi Mumbai

Approvals:

UGC-DEB | NAAC A+

Structure of the Program

- This three-year BBA in Banking and Insurance Program is specially designed to provide in-depth knowledge of Banking business operations and its practical application.

- It is designed to make students understand the day-to-day operations and activities of Banking and Insurance institutions.

- The diploma integrates the principles of Banking and Insurance with the concepts of business operations

Benefits of BBA in Banking and Insurance

Specialized Knowledge

A BBA in Banking and Insurance provides in-depth knowledge and understanding of the banking and insurance industries. Students gain insights into various aspects of financial services, including banking operations, insurance principles, risk management, and regulatory frameworks. This specialized knowledge prepares them for specific roles in these industries

Career Opportunities

The banking and insurance sectors offer a wide range of career opportunities. With a BBA in Banking and Insurance, graduates can explore job roles such as banking officer, loan officer, insurance agent, risk analyst, financial planner, and wealth management consultant. The demand for professionals in these fields remains consistently high, providing good prospects for career growth and advancement.

Industry-Relevant Skills

The BBA curriculum equips students with industry-relevant skills that are valued by employers. These skills include financial analysis, risk assessment, customer relationship management, financial planning, and regulatory compliance. Such skills are essential for success in the banking and insurance sectors and enhance employability.

Practical Exposure

Many BBA programs in Banking and Insurance incorporate practical training and internships, providing students with hands-on experience in real-world financial settings. This exposure helps them develop practical skills, gain industry insights, and establish professional networks, which can be advantageous when seeking employment after graduation.

Networking Opportunities

BBA programs often provide networking opportunities through industry guest lectures, seminars, and workshops. These events allow students to connect with professionals from the banking and insurance sectors, build relationships, and expand their professional network. Such connections can be valuable for internships, job placements, and future career opportunities.

Flexibility

Distance BBA programs provide the flexibility to study from anywhere, allowing students to access course materials, lectures, and assignments online. This eliminates the need for physical attendance, making it convenient for working professionals or those with other commitments.

Distance BBA programs often offer self-paced learning options, allowing students to study at their own pace and set their own schedules. This flexibility enables students to balance their studies with work or personal obligations, making it ideal for individuals seeking a flexible learning experience.

Distance BBA programs generally offer a wide range of elective courses, allowing students to choose subjects that align with their interests and career goals. This flexibility enables students to tailor their curriculum to focus on areas specific to banking and finance, such as financial management, investment analysis, banking operations, risk management, and more.

Accessibility

Distance BBA programs remove the barrier of geographical constraints, allowing individuals from different locations to pursue their degree. Students can enroll in the program from anywhere in the world, eliminating the need for relocation or commuting to a physical campus.

Distance BBA programs often have lower tuition fees compared to on-campus programs, making them more accessible to a wider range of students. Additionally, students save on expenses such as commuting, housing, and meals, further reducing the financial burden associated with pursuing a degree.

Distance BBA programs utilize online platforms and tools that facilitate communication and interaction between students, faculty, and support staff. These platforms include discussion forums, chat rooms, video conferencing, and email, allowing students to seek guidance, collaborate with peers, and engage with faculty members.

Placements in India

We Talent Explorer University Learning Services is proud to be associated with several esteemed institutions that prioritize the placement of their students. However, we believe that securing a placement solely depends on the student’s performance during interviews and their overall capabilities. We take into account various crucial aspects, including academic records, general knowledge, personality traits, technical knowledge, and more. By assessing these skills, we strive to provide our students with the best possible placement opportunities. However, we understand that not all students may succeed in securing a placement immediately. That’s where our Talent Explorer University Learning service comes in.

We offer free career advisory solutions to assist students in choosing the right career path that aligns with their unique talents and potential. Through personalized counseling and direction, we guide students toward making informed decisions about their future. Furthermore, our involvement in corporate recruitment allows us to collaborate with our partner companies and help place students in suitable positions. By offering a comprehensive range of services, we empower our students to succeed in their careers and pave the way for their professional growth.

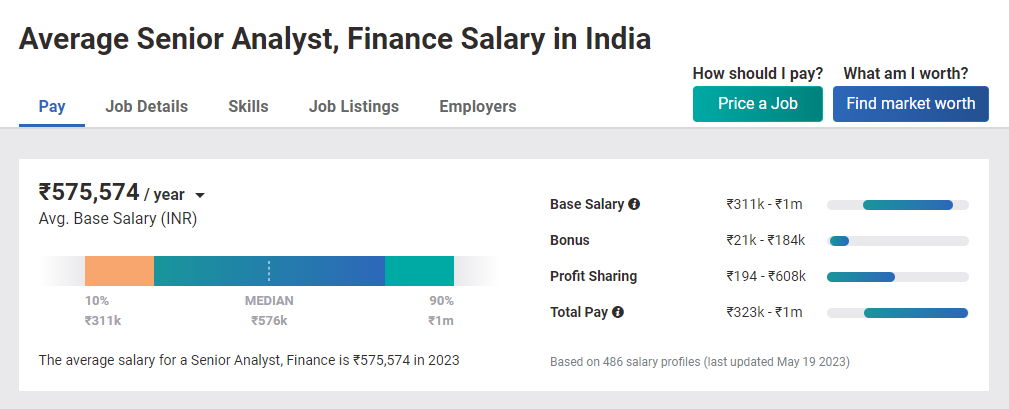

Salary After BBA in Banking and Insurance

In India, the salary range for BBA graduates in Banking and Insurance is quite broad. Entry-level positions in Banking and Insurance management may offer starting salaries in the range of ₹2 lakh to ₹6 lakh per annum, Mid-level Banking and Insurance roles can offer salaries in the range of ₹6 lakh to ₹10 lakh per annum while senior-level positions or Banking and Insurance roles in established organizations may provide salaries exceeding ₹10 lakh per annum

Source : Payscale

Industry-Relevant Skills:

- Financial Analysis

- Risk Management

- Banking Operation

- Insurance Principles

- Financial Planning

- Regulatory Compliance

- Customer Relationship Management

- Communication and Presentation Skills

Top Recruiters

FAQ's

A Distance BBA in Banking and Finance is an undergraduate degree program that focuses on the principles and practices of banking, financial management, and related areas. It provides students with a comprehensive understanding of financial markets, investment analysis, banking operations, risk management, and other relevant topics.

A Distance BBA program in Banking and Finance typically involves online lectures, virtual discussions, and assignments that students can access and complete remotely. The program may also incorporate online assessments, projects, and exams. Some programs may require occasional on-campus visits for practical sessions or exams.

After completing a Distance BBA in Banking and Finance, you can explore various career opportunities in the banking, finance, and related sectors. This may include roles such as financial analyst, investment banker, credit analyst, risk manager, financial planner, wealth manager, or banking officer, among others.

The duration of a Distance BBA program can vary depending on the university and the specific program. On average, it takes three to four years to complete a Distance BBA in Banking and Finance, similar to an on-campus BBA program

Yes, Distance BBA degrees in Banking and Finance are generally recognized and accepted by employers, as long as they are earned from accredited institutions. The knowledge and skills gained through a Distance BBA program in Banking and Finance are valued in the job market. However, it's important to ensure that the program you choose is offered by a reputable and recognized institution to enhance employability prospects.